The debt-to-income (DTI) ratio is calculated by dividing the borrower's monthly debt payments by the borrower's monthly gross income. Lenders use the percentage to gauge a borrower's ability to repay a loan based on their ability to handle monthly debt payments.

How To Analyze Your Debt To Income (DTI) Ratio

Maintaining a manageable level of debt to one's income indicates financial health. To put it another way, if your DTI ratio is 15%, then 15% of your monthly gross income is going toward paying down your debts. If a person's monthly debt payments exceed 30% of their income, this is considered a high DTI ratio.

Borrowers with a low proportion of debt to pay are more likely to meet their monthly debt obligations successfully. Therefore, financial institutions are picky about who they lend money, prioritizing those with low DTI rates.

Instructions For Computing the DTI

Personal finance is measured by the debt-to-income (DTI) ratio, which is the sum of all monthly debt payments divided by monthly gross income. Gross income is the amount you earn before deductions are made for taxes and expenses.

The debt-to-income ratio measures how much your monthly gross income goes toward paying off debt. Lenders, such as mortgage lenders, utilize the DTI ratio as one indicator of a borrower's financial health and capacity to make regular payments and repay loans.

The Ratio of Debt to Income Requirements

The debt-to-income ratio (DTI) is one indicator among several that lenders consider when deciding whether or not to extend loans. Consideration will also be given to the borrower's credit history and credit score.

Your credit score quantifies your ability to repay debts. Late payments, credit card balances about credit limit are all element that can have a good or negative effect on a credit score. 3

How To Reduce Debt Relative To Income

The ratio of monthly recurring debt to monthly gross income can be improved in two ways. If John maintains the same level of monthly debt at $2,000, but his monthly gross income rises to $8,000, his debt-to-income ratio will be calculated as $2,000 divided by $8,000.

This results in a DTI ratio of 25%. John's monthly recurrent debt payments would decrease to $1,500 if he could pay off his automobile loan, assuming his income remained the same at $6,000.

DTI Ratio: A Real-World Illustration

Among American financial institutions, Wells Fargo Corporation ranks high. The bank offers a variety of services, including mortgages and credit cards. Below is an explanation of what debt-to-income ratios they deem creditworthy and what proportions require work.

• 35% or less is considered manageable debt. Most people have some spare cash after paying their monthly expenditures.

• 36% to 49% is adequate, but you can improve. Lenders may impose additional qualifications.

• A high DTI ratio (50 percent or more) suggests you have little room for discretionary spending or savings. This leaves you with little room for error in the face of an unexpected expense and fewer lending possibilities.

Explain the Role of the Debt-to-Income Ratio.

Lenders consider your debt-to-income ratio or the proportion of your monthly gross income needed to service your debt obligations. Maintaining a manageable level of debt to one's income indicates financial health. If a person's monthly debt payments exceed 30% of their income, this is considered a high DTI ratio.

Borrowers with a low proportion of debt to pay are more likely to meet their monthly debt obligations successfully. Therefore, financial institutions are picky about who they lend money, prioritizing those with low DTI rates.

What Is an Acceptable Ratio of Debt to Income?

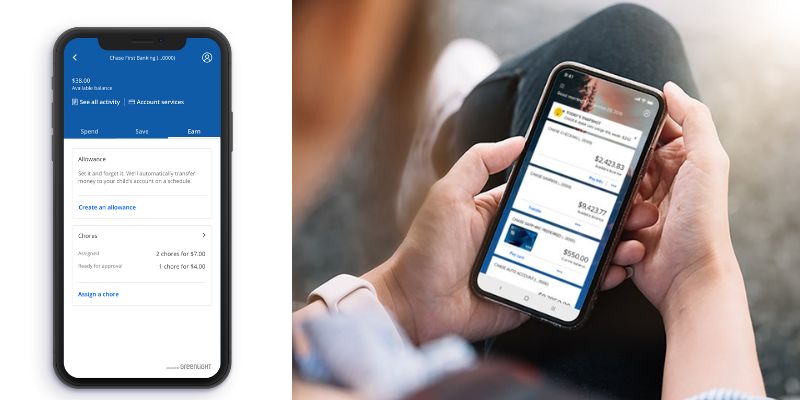

The maximum debt-to-income ratio (DTI) that will still allow a borrower to receive a mortgage is 43%. Lenders like borrowers with a debt-to-income ratio of no more than 36%, with no more than 28% of monthly income going toward paying off debts like mortgages and rent. 2 Lenders have varying maximum DTI ratios. However, if the debt-to-income ratio is modest, the borrower will have a greater chance of granting their credit application.

When Debt Exceeds Income, What Happens?

When calculating DTI, it does not matter what kind of debt you have or how much it costs to service that debt. Credit card interest rates are often far higher than those on student loans, yet both are included in the DTI ratio calculation.

You might reduce your monthly payments by transferring the balances from your high-interest cards to a card with a lower interest rate.